60% Of Vehicles In India Are Not Insured And Most Of These Are Two-Wheelers

Highlights

- Of the 60% vehicles that are not insured most are two-wheelers

- Two-wheelers have largest share in India's road accident and death figures

- Poor enforcement is a major reason why people do not purchase insurance

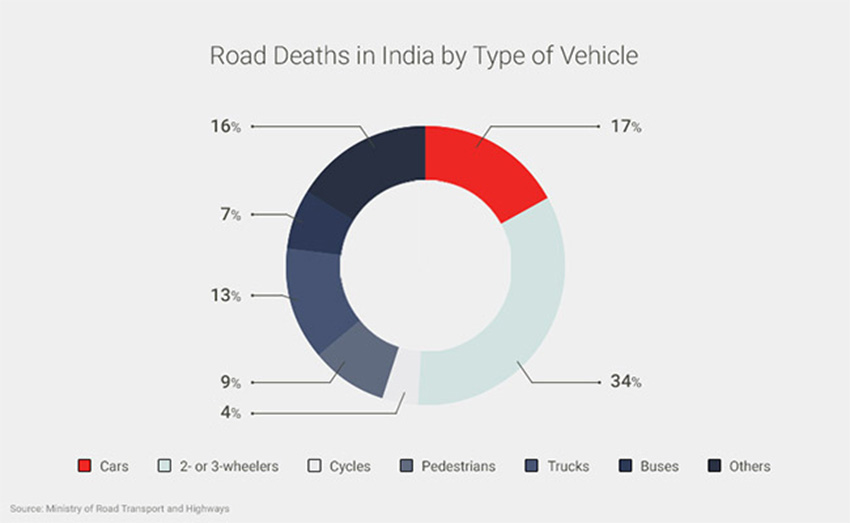

New Delhi: Stop at any traffic junction in India and you get a snapshot of the vehicular composition of its roads—a few buses, lots of cars and even more two-wheelers. These two-wheelers make-up roughly 76 per cent of urban traffic, and account for 34 per cent—the largest share—of road deaths in the country according to data compiled by the Ministry of Road Transport and Highways. Interestingly, despite third party motor insurance being mandated by law, a significant number of these two-wheelers are not insured.

Also Read: How Dangerous Are India’s Roads?

According to a General Insurance Council of India (GIC) report, nearly 60 per cent of vehicles in India are not insured and most of these are motorcycles and scooters. In 2015-16, India had around 19 crore registered vehicles. Of these, only 8.26 crore—less than half—were insured.

60% Of Vehicles In India Are Not Insured And Most Of These Are Two-Wheelers

NDTV spoke to a few owners of two-wheelers to find out why they hesitate from getting insurance.

“My scooter is really old and it’s second hand. Plus, the distance I travel is really short, so I thought, what’s the need?” says Yogendra Mittal, a tea and noodles stall owner in South Delhi’s Greater Kailash-I.

Listing a similar reason, Ramesh Mishra, a resident of Delhi’s Sangam Vihar says, “My scooter was insured for a few years but not once was I stopped. So when it lapsed, I decided to not renew it. It’s just a waste of money.”

A lot of motorists we spoke to reiterate the same point. They saw insurance as an added expenditure and one that they could avoid making since enforcement remains so poor.

Motor Insurance Laws in India

While insurance might be seen as a personal choice, the government has made it mandatory for every vehicle owner to have third party insurance. Simply put, this type of insurance covers injuries or death caused by one’s vehicle to another person and the damage caused to their property.

Read More: Motor Insurance Decoded: All You Need To Know About Insuring Your Vehicle

The Motor Vehicles Act 1988 makes having a valid ‘liability only’ to ‘third party’ insurance cover compulsory for all vehicles in the country and not having this can result in a fine of ₹1,000, 3 months imprisonment or both. In fact, the Motor Vehicles (Amendment) Bill proposes doubling this penalty to ₹2,000.

Also Read: Would Higher Traffic Fines Lead To Safer Driving In India?

Motor insurance is generally regarded as something central to road safety and responsibility, ensuring that compensation is provided to victims of road accidents and their property.

The annual premium to be paid for third party insurance policies is set by the Insurance Regulatory and Development Authority of India (IRDAI). Currently, for two-wheelers, this amount ranges between ₹569 and ₹796, varying according to the power of the engine.

Need For Stricter Enforcement

The share of two-wheelers in total road accidents has been increasing continuously—from 26.3 per cent in 2013 to 27.3 per cent in 2014 and 28.8 per cent in 2015, according to the Road Accidents in India 2015 report. In 2015, 36,803 people died and 1,35,343 were injured in accidents involving two-wheelers. Additionally, two-wheelers are identified as the most vulnerable road users.

This sheds light on the importance of having our vehicles insured. While premium rates are not very high, many people simply do not bother to buy a policy because they are certain that the likelihood of them being asked to show these papers is quite low and that is something worth thinking about.

if people have to claim . there is no claim for plastic parts, no claim for electrical parts,accident fir has to be registered, cost registering fir can be used for repairng vechiles, no police will raise fir for vechicle theft. why will people buy insurance.

I went to insure my car, which has a 1.3 litre engine, for third party insurance for one year with National Insurance. The cost is nearly Rs. 3650. Its too high.